Stress-Free Retirement Investing: How Retirees Can Invest Confidently

Investing in Retirement Should Feel Calm — Not Overwhelming

Retirement investing should feel calm and intentional, especially after years of saving and planning for the future. For many retirees, investing feels more stressful than it should. After decades of working and saving, the last thing you want is to feel anxious every time the market moves or a scary headline appears.

Yet retirees are often told they must:

-

Watch the market closely

-

React quickly to downturns

-

Understand complex charts and financial jargon

This pressure leads many people to make emotional decisions — selling during downturns or avoiding investing altogether. Fortunately, there is a calmer, simpler way to invest during retirement.

Stress-Free Retirement Investing, Why Doesn’t Need to Be Complicated

Why Emotional Investing Is Risky for Retirees

In retirement, protecting capital and maintaining steady growth becomes more important than chasing fast returns. Unfortunately, emotional investing can work directly against those goals.

Emotional investing often looks like:

-

Panic selling during market drops

-

Holding too much cash out of fear

-

Making sudden changes based on headlines

Research consistently shows that long-term investors who stay disciplined tend to perform better than those who frequently react to market noise. Firms such as Vanguard have long emphasized that patience and consistency are key drivers of investment success.

For retirees, reducing emotional decision-making isn’t just helpful — it’s essential.

A Simpler Long-Term Investing Approach for Retirement

Stress-Free Retirement Investing: A long-term, rules-based investing approach focuses on owning strong companies, holding them through market cycles, and allowing time to do the work.

Instead of worrying about daily price movements, retirees can focus on:

-

Company fundamentals

-

Long-term performance

-

Clear decision-making rules

This approach helps reduce stress and avoids the temptation to constantly adjust investments based on short-term market movements.

The challenge is finding tools that support this mindset without adding complexity.

A Tool Designed for Simplicity: TYKR

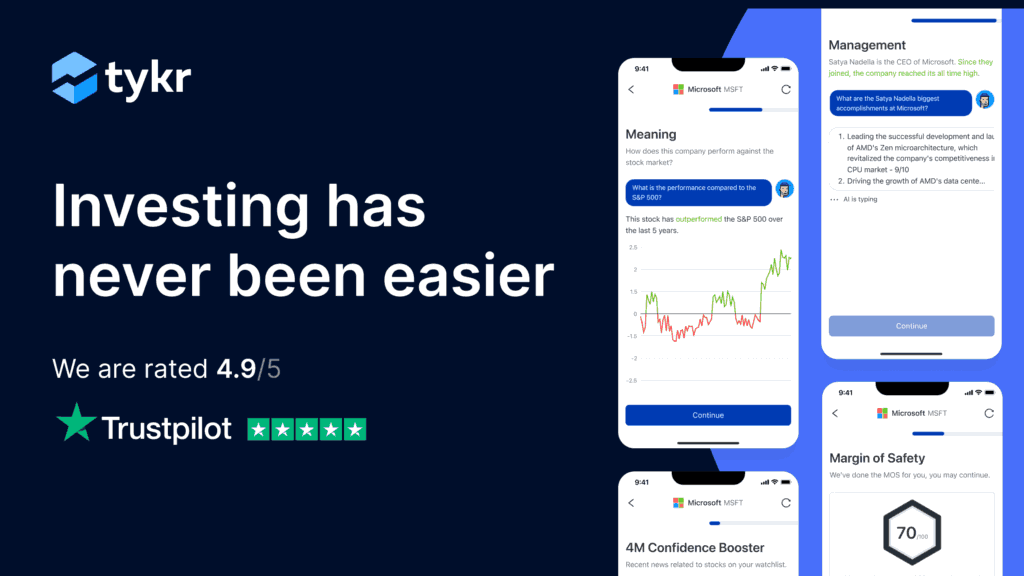

One investing platform designed specifically to simplify long-term decision-making is TYKR.

TYKR removes much of the complexity found in traditional investing tools. Instead of overwhelming users with technical indicators or complicated charts, it uses a straightforward rating system — Strong Buy, Buy, Hold, or Sell — based on fundamentals and long-term performance data.

This makes TYKR especially helpful for retirees who want to:

-

Avoid emotional decisions

-

Spend less time monitoring the market

-

Focus on long-term stability rather than short-term noise

Stress-Free Retirement Investing: If you’re looking for a calmer, more disciplined way to manage your investments during retirement, you can explore TYKR. You can trial it at no charge and if you find that you love it, send us a message and we’ll give you a 20% OFF coupon to signup!

Tykr stands by its guarantee. If a customer is charged after the 14-day free trial, they can ask for a refund within 30 days.

https://app.tykr.com/?red=papub

FTC Disclosure: This article contains one affiliate link. If you choose to sign up through this link, we may earn a commission at no extra cost to you. We only recommend tools we believe are helpful for long-term investors.

Stress-Free Retirement Investing: Why This Approach Works Well for Retirees

Retirees often benefit most from tools and strategies that emphasize clarity and consistency.

With a simplified, rules-based system:

-

Decisions are guided by data, not fear

-

Market volatility feels less overwhelming

Rather than reacting to every market swing, retirees can stay focused on long-term goals and income planning.

Final Thoughts: Investing with Confidence in Retirement

Retirement investing doesn’t need to be stressful or time-consuming. By focusing on fundamentals, maintaining discipline, and using tools that simplify decision-making, retirees can invest with confidence and peace of mind.

The goal isn’t to predict the market — it’s to stay consistent, reduce emotional reactions, and allow long-term strategies to work over time. Tools like TYKR are designed to support that approach by making investing clearer and more manageable for retirees.

Frequently Asked Questions About Stress-Free Retirement Investing

What is the best approach to retirement investing?

The best approach to retirement investing is one that prioritizes long-term stability, disciplined decision-making, and simplicity. This approach to retirement investing helps retirees avoid emotional decisions, especially during periods of market volatility. By focusing on fundamentals and long-term goals, retirees can invest with greater confidence.

How can retirees reduce stress when investing?

Stress often comes from complexity and uncertainty. Simplifying retirement investing allows for greater peace of mind by reducing the need to constantly monitor the market or react to short-term price movements. Clear rules and a long-term mindset can make investing feel more manageable.

Is long-term retirement investing safer than short-term strategies?

For many retirees, long-term strategies are considered safer because they reduce the impact of short-term market swings. Tools that support long-term retirement investing can reduce stress by encouraging consistency and helping retirees stay focused on fundamentals rather than daily headlines.

Do retirees need to watch the stock market every day?

No. Retirement investing does not require daily market monitoring. Many retirees prefer using tools and strategies that provide clear guidance and reduce the need for constant attention, allowing them to focus on enjoying retirement rather than tracking market movements.

Can a tool really help simplify retirement investing?

Yes. Many retirees find that having a clear, rules-based system makes retirement investing feel far more manageable. Instead of relying on guesswork or reacting emotionally to market news, simplified tools can provide consistent guidance based on long-term fundamentals.

For retirees who want clarity without complexity, platforms like TYKR are designed to support a calm, long-term approach to retirement investing. By using straightforward stock ratings and focusing on fundamentals, TYKR helps retirees spend less time worrying about the market and more time enjoying retirement.

If you’re exploring ways to make retirement investing less stressful and more disciplined, you can learn more about TYKR here:

https://app.tykr.com/?red=papub